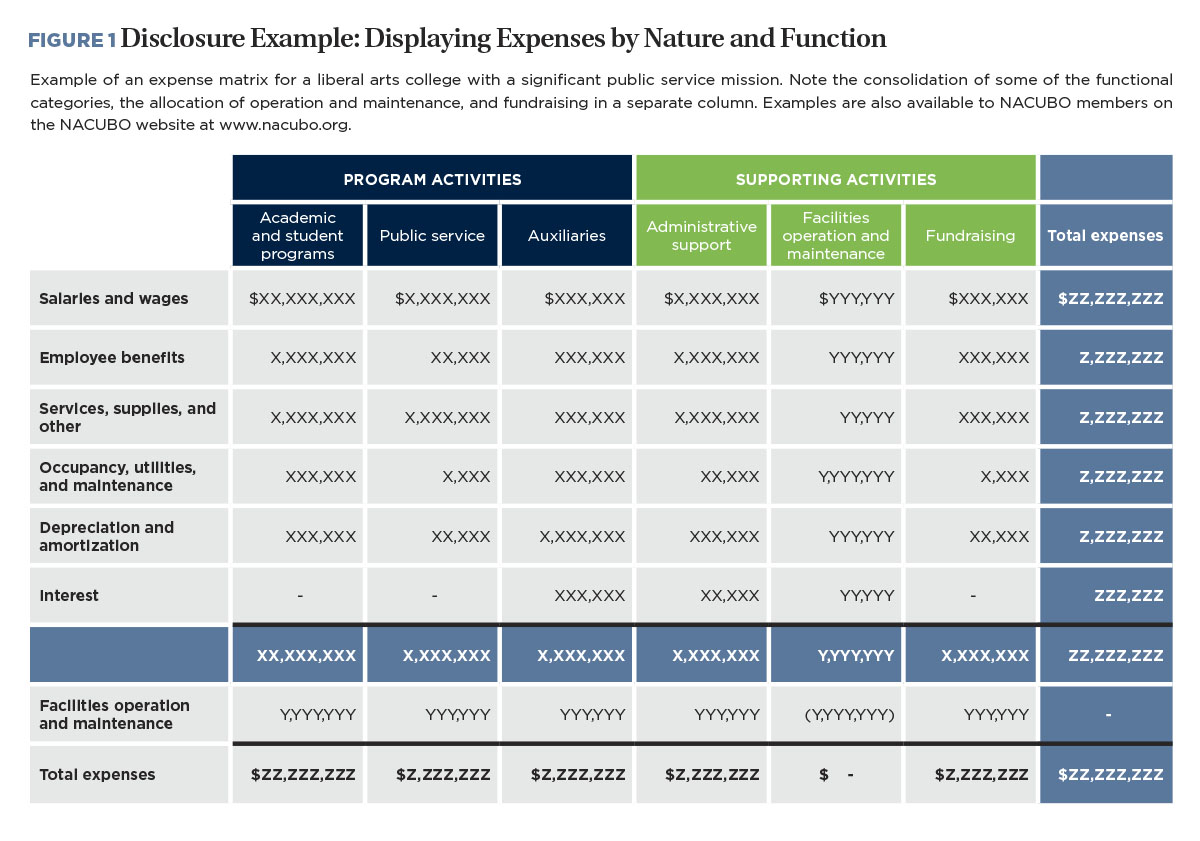

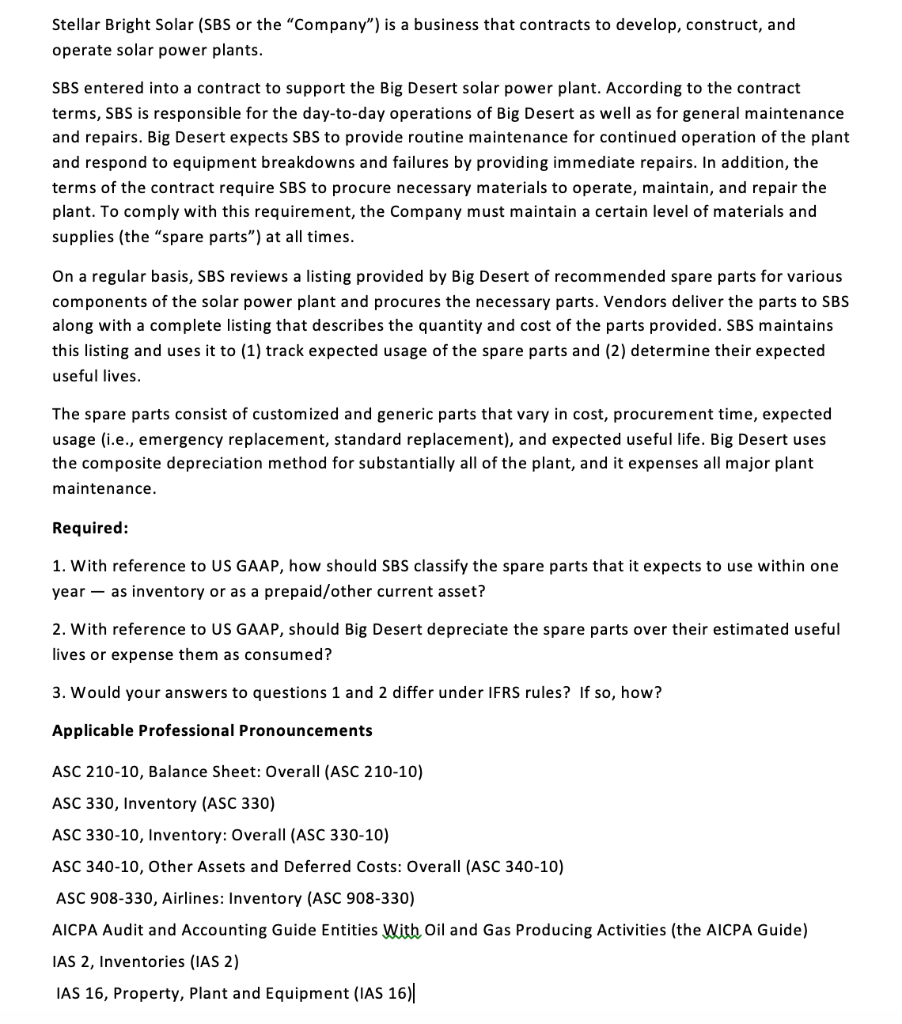

These fixed assets are required to be depreciated periodically in an organized and regular manner based on a reasonably comprehensive.

Gaap depreciable life of solar panels.

Such as solar panels in the case of solar energy and wind turbines in the case of wind energy.

This means the owner is able to deduct 85 percent of his or her tax basis.

An adjustment in the useful life of a depreciable asset for which depreciation is determined under section 167.

In renewable energy businesses investment in fixed assets accounts for the majority of the construction cost.

46 and 48 and a special allowance for depreciation under sec.

Established a basis in solar panels and related equipment for purposes of claiming an energy credit under secs.

Satisfied the requirements of then applicable sec.

Normally the depreciable life of solar panels is 85 of the full solar system cost which may be depreciated roughly as follows year 1 20 year 2 32 year 3 19 2 year 4 11 5 year 5 11 5 and year 6 5 8.

A change in use of an asset in the hands of the same taxpayer.

The tax cut and jobs act of 2017 brought with it the option for 100 bonus depreciation on solar systems which is often a great way for businesses to quickly recover costs associated with integrating solar energy.

For equipment on which an investment tax credit itc the owner must reduce the project s appreciable basis by one half the value of the 30 itc.

Put simply depreciation is a decline in an asset s value over time.

Making a late depreciation election or revoking a timely valid depreciation election including the election not to deduct the special depreciation allowance.

However this year you can use 100 bonus depreciation if you would like to take the full cost as depreciation expense in 2018.

The market certainty provided by macrs has been found to be a significant driver of private investment for the solar industry and other energy industries.

More importantly i don t know your whole situation but i feel like you are eligible for a form 3468 investment credit for your solar panels.

Under macrs all of your qualifying commercial solar assets will fully depreciate within five years.

Had sufficient amounts at risk under sec.

It looks like solar panels have a 5 year life.

Qualifying solar energy equipment is eligible for a cost recovery period of five years.

Are you interested in a free solar consultation to show you what the numbers could look like.